Over the past 5 years, there has been a decreased in false claims recoveries by the DOJ. That trend was resoundingly reversed in fiscal year 2021.

In a press announcement on February 1, 2022, the DOJ released the following figures related to the 2021 civil fraud recoveries by the agency:

The Justice Department obtained more than $5.6 billion in settlements and judgments from civil cases involving fraud and false claims against the government in the fiscal year ending Sept. 30, 2021. This is the second largest annual total in False Claims Act history, and the largest since 2014.

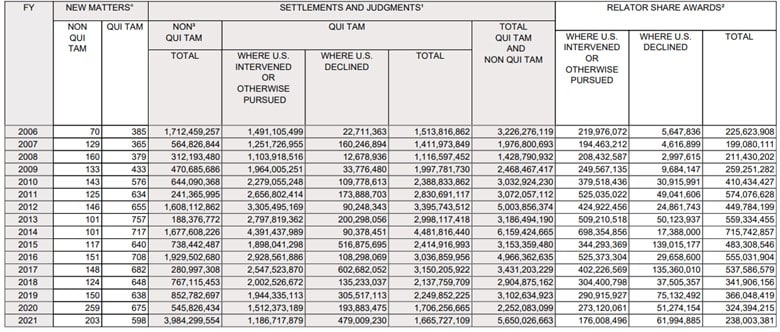

This increase is more than double the recoveries in 2020, as shown by the DOJ’s 2006-2021 summary of all recoveries across all agencies.

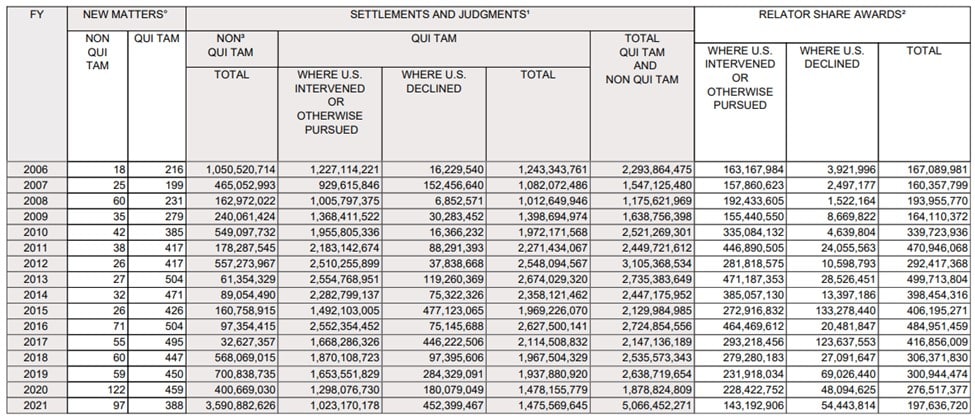

While impressive, the real story about these recoveries is reflected in the Health and Human Services recoveries statistics shown below, which overwhelmingly accounted for the higher 2021 numbers:

As summarized in the DOJ press release, of the more than $5.6 billion in settlements and judgments reported by the Department of Justice this past fiscal year, over $5 billion relates to matters that involved the health care industry, including drug and medical device manufacturers, managed care providers, hospitals, pharmacies, hospice organizations, laboratories and physicians. The amounts included in the $5 billion reflect recoveries arising from only federal losses, and, does not reflect additional amounts recovered for state Medicaid programs.

The higher recovery amounts reflect the $2.8M settlement with Purdue Pharma in 2021 but the dollar recovery is not the full story here. The DOJ has expressed its intent to vigorously pursue health care fraud, and based on the entities who were targeted and the recoveries claimed. As reflected in the 2021 recoveries, the DOJ met its reiterated goals of deterring others who might try to cheat the system for their own gain and protecting patients from medically unnecessary or potentially harmful actions.

In addition to the opioid-related recoveries, the 2021 False Claims Act (FCA) recoveries in the health care industry reflect the success of the DOJ in pursuing several areas, including Medicare Advantage (Part C) fraud and unlawful kickbacks.

Medicare Advantage Fraud

The CMS Medicare Advantage program provides a managed care option to Medicare enrollees. This program is also known as Medicare Part C. In 2021, more than 26 million Medicare beneficiaries were enrolled in Part C plans.

Medicare Part C differs from” traditional” Medicare in that Medicare in several key aspects. For example, Part C- participating health plans are paid a monthly capitation payment for each Medicare enrollee rather than on a fee-for-service basis where a payment is made for each distinct patient admission or service. Under Medicare Part C, CMS adjusts the monthly capitated payments for various “risk” factors that affect expected healthcare expenditures to ensure that plans are paid more for enrollees who pose a greater risk. In 2021, the Congressional Budget Office projected that CMS would pay more than $343 billion to private carriers who offered those plans.

The use of a risk adjustment process has created opportunities for health plans and providers to artificially inflate capitation amounts by submitting unsupported diagnosis codes to make their patients appear sicker than they actually are. In 2021, the DOJ settled a large California-based health care services provider, which paid $90 million to resolve allegations that it knowingly submitted unsupported diagnosis codes for certain patient encounters, resulting in inflated payments to the organization. Another west coast plan paid $6.3 million to resolve allegations that it submitted invalid diagnoses and received inflated payments as a result. The DOJ has recently intervened in qui tam cases (filed under the False Claims Act) against a west coast health care organization alleging that the organization submitted or caused the submission of inaccurate information about the health status of enrolled beneficiaries to increase reimbursement from Medicare. The DOJ focused on two practices in particular – data mining and retrospective chart reviews where reviewers were allegedly instructed to focus on potential new diagnoses, which can drive higher reimbursement. These cases foreshadow the continued focus of the DOJ to aggressively pursue FCA enforcement through scrutiny of risk adjustment practices.

Unlawful Kickbacks

Health care has long been plagued by the problem of kickbacks where parties intentionally create schemes to inflate their reimbursement through unlawful side deals. The DOJ has used the FCA to address Anti-Kickback Statute (AKS) culpability quite actively in 2021 to pursue such schemes.

- The DOJ settled for $160 million in a case where an organization was alleged to have paid kickbacks to Medicare beneficiaries by pro providing them “free” or “no cost” diabetic testing glucometers and by routinely waiving or not making reasonable efforts to collect their copayments for glucometers and diabetic testing supplies.

- In another example, the department resolved its claims against pain management clinics and urine drug testing (UDT) laboratories for paying unlawful kickbacks to providers to induce their referrals of urine drug tests, obtaining default judgments totaling more than $140 million

Recently, the DOJ has also been focused on how electronic medical records (EHR) can be used for fraudulent purposes. EHR technology usage has been driven by federal mandates related to improve the quality, safety, and efficiency of patient care and as a result, is integral to modern health care delivery. However, EHRs create increased opportunity for fraud because of the potential for misuse. In addition to cases where EHR vendors who intentionally programmed EHR systems to intentionally inflated claims sent to federal health care programs, EHR vendors also engaged in other schemes. In 2021, the DOJ filed suit against an EHR vendor for receiving kickbacks in the form of “sponsorship payments” from pharmaceutical companies in exchange for allowing them to participate in the development of clinical decision support alerts intended to increase prescriptions for the pharmaceutical companies’ products. The vendor entered into a deferred prosecution agreement in which it agreed to pay nearly US$26 million in criminal fines and the forfeiture of criminal proceeds, as well as civil penalties of over US$118 million to settle FCA violations. Health plans and EHR vendors should anticipate that the DOJ will continue to develop its expertise in and pursuit of complex EHR-related fraud schemes.

Changes Ahead for the FCA

There has been recent congressional action to toughen the standards for FCA enforcement. These relate to the ability of the DOJ to dismiss fraud cases over the objection of whistleblowers, as well as high court decisions that arguably making it easier for defendants to escape FCA liability by challenging materiality of actions taken. Senator Grassley and others supportive of the FCAA have also bluntly stated that recent judicial interpretations “have made it all too easy for fraudsters to argue that their obvious fraud was not material simply because the government continued payment.” Based on the successes of the DOJ in 2021 to pursue a broad range of schemes and their perpetrators under the FCA, as well as the changes that are being actively pursued at the federal legislative level, the health care industry should expect continued aggressive prosecution by the DOJ moving forward into 2022 and beyond.