Background

The function of state Medicaid Fraud Control Units (MFCUs) is to investigate and prosecute Medicaid provider fraud and patient abuse/neglect. The Social Security Act requires each state to operate a MFCU. MFCUs are funded jointly by federal and state governments – each Unit receives a federal grant award equivalent to 75 percent of its total expenditures to fund its activities. This grant award must be recertified each year by the OIG for continued federal funding.

Reducing Medicaid fraud and maximizing the effectiveness of MFCUs are top priorities for the OIG, and the OIG’s oversight of the MFCUs supports both goals. OIG oversight of MFCUs includes annual recertification of each Unit, conducting periodic on-site inspections of Units, providing technical assistance and monitoring key statistical data about each Unit’s performance.

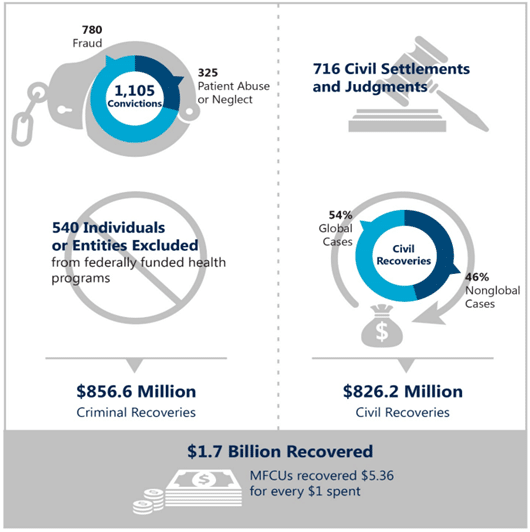

Each year, the OIG issues a report regarding the overall performance of MFCUs nationally. In March 2022, the OIG issued its fiscal year 2021 report. As shown below, 2021 reflected an overall strong showing by the MFCUs. Overall, MFCUs’ efforts in FY 2021 contributed to total recoveries of $1.7 billion, with an ROI of $5.36 for every $1 spent.

Comparing these outcomes to 2020, the conviction rate was nearly identical (1,105 in 2021 and 1, 017 in 2020). Similar to previous years, significantly more convictions for fraud involved personal care services (PCS) attendants and agencies than any other provider type. Civil settlements and judgments fell slightly, from 786 in 2020 to 716 in 2021. However, there were some notable differences in the federal exclusion rate as well as civil and criminal recoveries and overall recovery rates.

Federal Exclusions:

Providers convicted of Medicaid fraud and abuse charges and serious professional misconduct can be excluded from participating in any federal healthcare program, including Medicaid and Medicare. Anyone who hires an individual or entity on the OIG exclusion list may be subject to fines – and the knowledge that they put their own patients at risk. State MFCUs are required to timely report to the OIG state actions taken against individuals and entities related to Medicaid fraud so that cases can be reviewed for federal exclusion.

In 2021, there was a significant decline in the number of exclusions compared to 2020 – dropping from 928 exclusions in 2020 to 540 in 2021 which represents a 42% drop in exclusions in one year. The report offers no explanation for this significant change. Since exclusion rates are driven largely by the number of state case submissions and the severity of the cases submitted, there is no clear reason for the decrease.

Civil Recoveries

Civil recoveries reflect the amount recovered by MFCUs through civil (versus criminal) actions for fraudulent activities. Civil cases can be pursued individually by a state MFCU or in partnership with another MFCU and/or the OIG. 2021’s statistics reflect a distinct shift away from civil recoveries in “global” cases – 54% of civil recoveries were the result of global cases in 2021 compared to the 74% of recoveries in 2020. The recovery amounts year-to- year were relatively stable – in 2020, the MFCUs and OIG activities resulted in $855 million in civil recoveries, compared to the $826 million in 2021.

While the overall amounts were comparable between 2020 and 2021, there were notable differences in the size of the settlements. In one massive global case in 2021 which involves a pharmaceutical manufacturer, all fifty states, the District of Columbia, and Puerto Rico partnered with Federal agencies to pursue allegations that the pharmaceutical manufacture promoted the sale and use of an opioid treatment drug to physicians who were improperly prescribing the drug. In addition, the manufacturer allegedly promoted the drug using false and misleading claims and took steps to fraudulently delay the entry of generic forms of the drug. As a result of the investigation, the pharmaceutical manufacturer agreed to pay a total of $300 million—$91 million of which was related to State Medicaid programs.

Criminal Recoveries

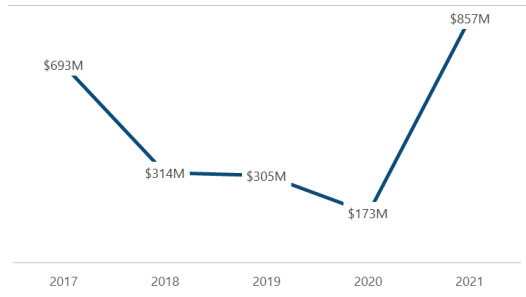

The largest increase in recoveries by far was in the area of criminal recoveries. MFCU criminal recoveries increased substantially from $173 million in 2020 to $857 million in 2021. The increase was primarily the result of cases prosecuted by MFCUs in Virginia and Texas. Those MFCUs reported a combined $714 million in criminal recoveries (approximately 83 percent of the total reported criminal recoveries). The Texas MFCU reported a large criminal recovery in 2021 following the prosecution of a corporate executive who falsely informed patients with long-term, incurable diseases that they had less than 6 months to live and subsequently enrolled them in hospice programs. The court ordered the defendant to pay $120 million in restitution and sentenced the defendant to 20 years in prison.

Total criminal recoveries varied over the 5-year period ending in FY 2021:

Beneficial Practices Recognized

The 2021 report also recognized the many beneficial practices that MFCUs have adopted to improve their outcomes and performance over the last decade. These practices are identified by the OIG during its regular inspections of state MFCUs, and are published yearly to assist other MFCUs which may want to consider for adoption. In addition to identifying beneficial practices to spur continued improvement, OIG annually recognizes the efforts of one MFCU with the Inspector General’s Award for Excellence in Fighting Fraud, Waste, and Abuse. In 2022, the Ohio MFCU received this award for its high number of case outcomes across a mix of case types, excellent partnership with OIG and other Federal and State partners, and regular contributions to the larger MFCU community.

These practices reflect the over-arching goals of MFCUs, which include:

- Increased fraud referrals from state Medicaid partners, the public and managed care organizations;

- Enhanced collaboration and communication between the MFCU and the OIG as well as its state agency partners. Also, enhanced partnership between state MFCUs on common interests such as training;

- Education of the community and the health care industry about the role of MFCUs;

- Streamlined systematic processes to promote fraud referrals from other state agencies as well as to improve case management practices required such as supervisor case reviews and OIG referral practices; and

- Improved training of MFCU staff to develop staff and attorney capabilities and to improve litigation outcomes.

Conclusion

During 2021, the MFCUs continued to operate under the shadow of the pandemic which introduced new potential areas of fraud. In addition, the backlog of cases from 2020 at a time of staff shortages further stressed many MFCUs. Notwithstanding these challenging circumstances, state MFCUs continued to perform at very high levels as evidenced by these outcomes. Their work drives the majority of federal exclusions that protect federal health program beneficiaries from individuals and entities who engage in fraudulent or criminal conduct related to Medicare and Medicaid programs.