The cases presented below prove that fraud hurts real people every single time it happens. Outstanding medical bills have become a chief reason for filing personal bankruptcy in the US. The health of patients continue to deteriorate because of neglect and false diagnoses. Fraud is a real issue that needs to be addressed and halted in its tracks immediately.

There are many reasons why people commit medical fraud. Greed is a prime motivation, but as can be gleaned from the following examples, the justification and methods vary wildly.

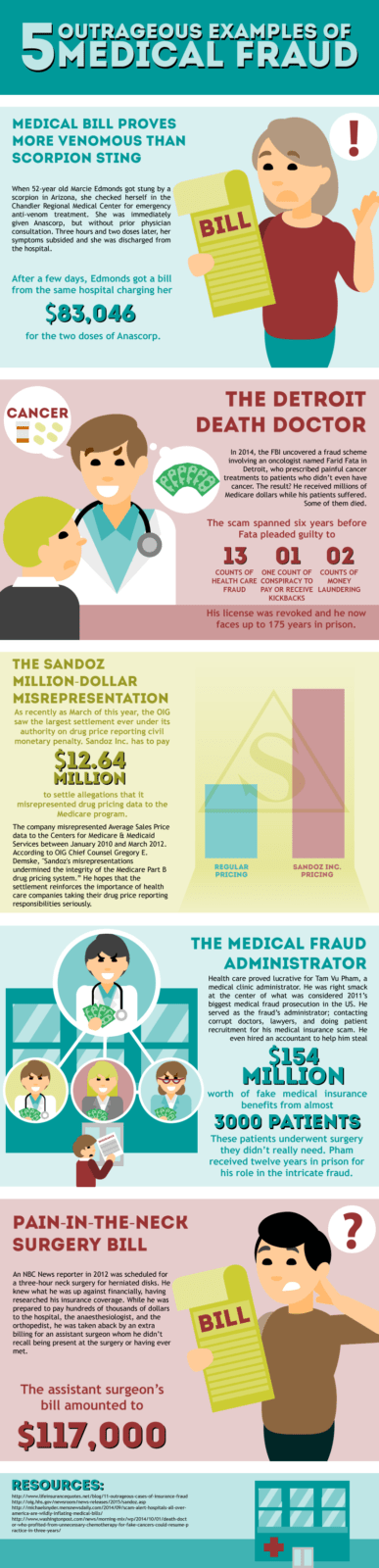

Medical Bill Proves More Venomous than Scorpion Sting

When 52-year old Marcie Edmonds got stung by a scorpion in Arizona, she checked herself in the Chandler Regional Medical Center for emergency anti-venom treatment. She was immediately given Anascorp, but without prior physician consultation. Three hours and two doses later, her symptoms subsided and she was discharged from the hospital. After a few days, Edmonds got a bill from the same hospital charging her $83,046 for the two doses of Anascorp.

The Detroit Death Doctor

In 2014, the FBI uncovered a fraud scheme involving an oncologist named Farid Fata in Detroit, who prescribed painful cancer treatments to patients who didn’t even have cancer. The result? He received millions of Medicare dollars while his patients suffered. Some of them died.

The scam spanned six years before Fata pleaded guilty to 13 counts of health care fraud, one count of conspiracy to pay or receive kickbacks, and two counts of money laundering. His license was revoked and he now faces up to 175 years in prison.

The Sandoz Million-Dollar Misrepresentation

As recently as March of this year, the OIG saw the largest settlement ever under its authority on drug price reporting civil monetary penalty. Sandoz Inc. has to pay $12.64 million to settle allegations that it misrepresented drug pricing data to the Medicare program.

The company misrepresented Average Sales Price data to the Centers for Medicare & Medicaid Services between January 2010 and March 2012. According to OIG Chief Counsel Gregory E. Demske, “Sandoz’s misrepresentations undermined the integrity of the Medicare Part B drug pricing system.” He hopes that the settlement reinforces the importance of health care companies taking their drug price reporting responsibilities seriously.

The Medical Fraud Administrator

Health care proved lucrative for Tam Vu Pham, a medical clinic administrator. He was right smack at the center of what was considered 2011’s biggest medical fraud prosecution in the US. He served as the fraud’s administrator; contacting corrupt doctors, lawyers, and doing patient recruitment for his medical insurance scam. He even hired an accountant to help him steal $154 million worth of fake medical insurance benefits from almost 3000 patients. These patients underwent surgery they didn’t really need. Pham received twelve years in prison for his role in the intricate fraud.

Pain-in-the-Neck Surgery Bill

An NBC News reporter in 2012 was scheduled for a three-hour neck surgery for herniated disks. He knew what he was up against financially, having researched his insurance coverage. While he was prepared to pay hundreds of thousands of dollars to the hospital, the anaesthesiologist, and the orthopedist, he was taken aback by an extra billing for an assistant surgeon whom he didn’t recall being present at the surgery or having ever met. The assistant surgeon’s bill amounted to $117,000.

What has health care and insurance become that it no longer protects its patients, but makes their situation worse with these reprehensible and outrageous acts?

Resources:

http://www.lifeinsurancequotes.net/blog/11-outrageous-cases-of-insurance-fraud/